Author:

Professor Andrew Schmitz, Ph.D., D.Litt.

Eminent Scholar: Ben Hill Griffin Jr. Endowed Chair

Food and Resource Economics

Nature.com reports that farmers in Ukraine are extremely stressed because of bombings and fighting the invaders. Truth is that irrespective of where and what, the intertwined nature of food production, supply, and distribution in a global economy is likely to impact the prices in the U.S., and food security across the world for some time to come.

A look at the numbers

Ukraine has 102.5 million acres of farmland, much of very high quality. Ukraine produces about 20% of the world’s high-grade wheat. In 2021, it had 14% of the world wheat export market. Ukraine also supplies significant corn (15%), barley (15%) and rye to Europe and exports 60% of its large production of sunflower oil and seed.

Even before the invasion, the prices of grain and oilseed commodities were already skyrocketing, and my colleagues’ and my research emphasizes that the invasion of Ukraine by Russia has added fuel to the fire (Agricultural Policy, Agribusiness, and Rent-Seeking Behaviour, Forthcoming, 2022). Prior to the invasion in 2022, 1) some grain and oilseed prices were at record highs; 2) input costs were at high levels, and 3) supply chain disruptions were rampant. The prices of inputs, including fuel, pesticides, herbicides, and fertilizer used by farmers had also increased dramatically, mostly during the Fall of 2021. Fertilizer and chemical prices more than doubled during 2021.

Ryan Dezember makes this point in the April 13, 2022, edition of The Wall Street Journal in his article “Commodity Market Swings Snarl Real World Business.” He says, “Russia’s invasion of Ukraine has added to market disruption, especially in energy and grain sectors. Bouts of inclement weather and supply chain problems have complicated delivery in some markets.” As a result, consumer prices have increased dramatically, as have input prices.

What might happen to agricultural production in Ukraine and Russia in 2022?

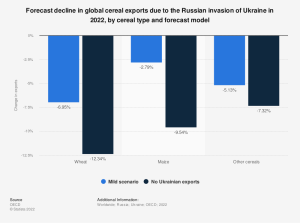

In Ukraine, the harvesting of winter wheat will begin this June. It is possible that the production and exports of corn, wheat, and sunflowers could be significantly lower than in 2021. If this is the case, there could be further increases in the price of food commodities worldwide. Keep in mind that many food commodities are produced and traded worldwide. Therefore, major disruptions of food production in Russia and Ukraine could trigger significantly higher commodity prices.

Ukrainian farmers are giving up farming to fight in the war. Also, high agricultural productivity in Ukraine is partly due to intensive use of fertilizers, chemicals, and herbicides, which have become extremely limited due to supply chain disruptions. Total productivity in grains and oilseeds also relies to some extent on the use of modern U.S. farm technologies, including John Deere tractors and John Deere and Case International grain harvesters.

Farm storage is needed for successful grain farming. Storage facilities may well have been damaged in the invasion. Ships and roads for transporting grain are tied up by the Russians. In assessing the agricultural damage from the invasion, consider that Ukraine produced 54 million metric tonnes of wheat in 2021. Canada, a large wheat-growing area, in the same period, produced 30 million metric tonnes. Therefore, if the total Ukraine wheat crop were destroyed from the invasion, the impact on world food commodity prices would be major.

The magnitude of Western sanctions against Russia will have significant impacts on agricultural trade. For example, sanctions on Russian exports of oil and natural gas drive up energy and fertilizer prices—major inputs used by farmers worldwide. However, Russia has suspended food and fertilizer exports. It had done so earlier between 2007 and 2011. To learn more about the current situation’s effect on fertilizer and agricultural supplies, see a recent blog post from Rao Mylavarapu.

0

0