Tax season is here, and for many, it can feel overwhelming. Whether you’re filing for the first time or you’ve been doing it for years, staying organized and informed can make the process much smoother. Here are some practical tips to help you navigate tax season with confidence.

Gather Your Documents

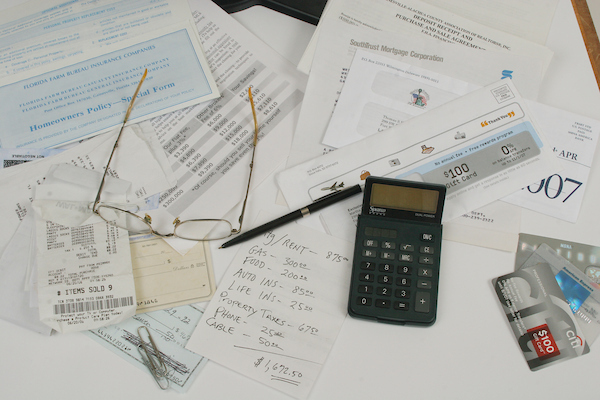

UF/IFAS Photo by: Thomas Wright.

Collecting all necessary paperwork (where applicable):

• W-2: Used to report wages and salary

• 1099-INT: Reports interest from bank accounts or other investments.

• 1099-DIV: Reports dividends earned from investments.

• 1099-B: Reports income from the sale of investments.

• 1099-R: Reports distributions from retirement accounts.

• 1098-T: Used to report scholarship/grant income and tuition paid.

• 1099-G: Reports unemployment compensation.

• 1099-K: If you have a gig type job.

• SSA-1099: Used to report social security benefits.

• W-2G: Used to report any gambling winnings.

• 1099-MISC/1099-NEC: Used to report self-employment income.

• Receipts for deductible expenses

• Mortgage statements and property tax records

Keeping these documents in one place will save time and reduce stress.

Remember don’t file your taxes until you know you have all your documents.

Understand Your Tax Obligations

If you live in Florida, you’re in luck—there’s no state income tax. However, federal taxes still apply.

Remember:

• Taxes are based on a pay-as-you-go system

• Estimate how much you will owe with the IRS’s W-4 Estimator

• Filing a return ensures you reconcile what you owe versus what you’ve paid

• If you’re self-employed, plan for quarterly payments so you don’t have to pay penalties on the taxes you owe

Review Tax Credits

There are two types of tax credits:

A nonrefundable tax credit means you get a refund only up to the amount you owe.

A refundable tax credit means you get a refund, even if it’s more than what you owe.

Popular credits include:

• Child Tax Credit

• Earned Income Tax Credit

• Saver’s Credit

• Child and Dependent Cared Credit

• Credit for other dependents

• Adoption Credit

• Energy Credit

• American Opportunity Tax Credit

• Lifetime Learning Credit

Free File Resources

There are several free programs to help you file:

• VITA (Volunteer Income Tax Assistance)

• AARP Tax-Aide

• IRS Free File

• UF/IFAS Virtual VITA for Florida residents

These services can help you avoid costly mistakes and save money.

Need Help?

If you have questions or need assistance, reach out to your local UF/IFAS Extension office. Many offer free financial counseling and tax prep resources.

0

0