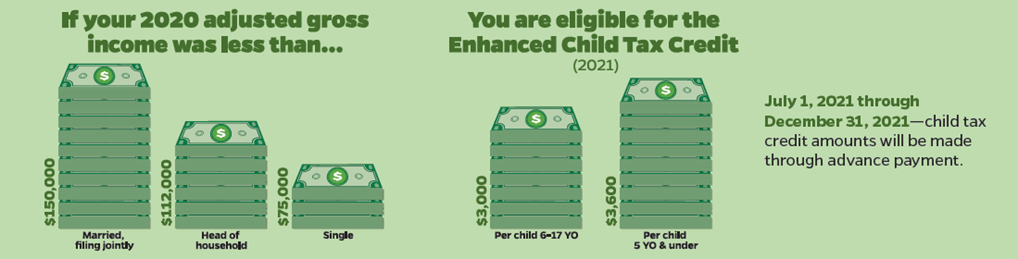

Do you have children or grandchildren? If so at this point, you have probably heard about the changes to the Child Tax Credit through the American Rescue Act. However, for most people it seems to bring more questions than answers and now they are sending letters to those eligible with little information. So let’s get you the facts so you can understand what is really going on.

The Child Tax Credit has been a credit offered to parents of children in previous tax years, but for tax year 2021 it will be different. The credit amount has increased, the amount refundable has changed, and how you receive this refund has changed as well.

The basic breakdown:

- Credit Amount:

- Children under age 6- $3,600

- Children age 6-17 – $3,000

- Amount refundable in 2021:

- Children under age 6- $3,600

- Children age 6-17 – $3,000

- How refund can be received:

- In monthly payments July-December 2021

- Children under age 6- $300 per month

- Children age 6-17 – $250 per month

- In a lump sum when you file your 2021 taxes

- In monthly payments July-December 2021

*Ages are based on age turned to in 2021

Things to remember:

- What you receive during July-December 2021 will be subtracted from the total credit amount you receive when paying your 2021 taxes.

- If you have owed taxes in the past you may want to use this credit towards your taxes due for 2021 and not receive the monthly payments.

- This is not like the stimulus payments, it is a part of your tax refund.

- If you would rather not receive the payments, you must opt out of them at irs.gov/childtaxcredit2021.

For more information click here.

2

2