Financial security is essential to our quality of life. However, learning how to be financially secure isn’t something usually taught on the job or in school. Some people may think financial education is only for those who can afford it, but the truth is, in most cases, people with limited means are most in need of help with managing their money. Fortunately, thanks to a partnership between UF/IFAS Extension and Bank of America, Floridians of all ages and income levels can have access to free counseling and financial management education.

An Idea That Just Made “Cents”

Bank of America began partnering with UF/IFAS Extension in 2009, during the height of the financial crisis. Michael Gutter, then associate dean for Extension Family and Consumer Sciences, reached out to Bank of America with an idea: creating a program that would train volunteers to give one-on-one counseling to people who were struggling financially. If master gardeners could show people how to grow their own vegetables, why couldn’t master money mentors show families how to avoid foreclosure, balance their checkbooks, establish good credit and even save for a house?

Bank of America began partnering with UF/IFAS Extension in 2009, during the height of the financial crisis. Michael Gutter, then associate dean for Extension Family and Consumer Sciences, reached out to Bank of America with an idea: creating a program that would train volunteers to give one-on-one counseling to people who were struggling financially. If master gardeners could show people how to grow their own vegetables, why couldn’t master money mentors show families how to avoid foreclosure, balance their checkbooks, establish good credit and even save for a house?

Bank of America provided a generous gift to get the mentor program started in 2010 and has a been a valued partner with Extension ever since, providing more than $1.2 million of support for a diversity of financial education programs. It was recognized for its outstanding support as the 2022 UF/IFAS Extension Advocate. Video: Bank of America, UF/IFAS Extension Advocate

Master Money Mentors and More

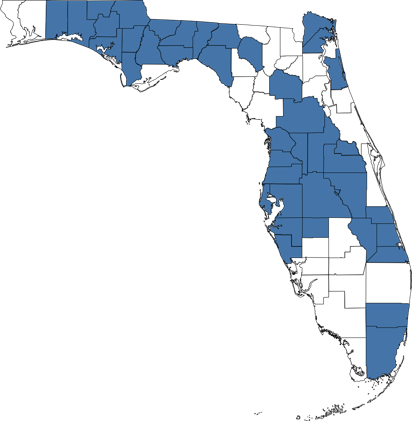

The Florida Master Money Mentor program has trained more than 600 volunteers in 41 counties and continues to expand into rural areas and urban centers where low- and moderate-income families need help the most. Participants in the program receive free, one-on-one financial education from mentor volunteers in developing spending plans, organizing financial records, understanding credit and planning for the future.

UF/IFAS Extension also assists people struggling with their taxes through the Volunteer Income Tax Assistance program (VITA). In addition to helping taxpayers get the refunds and earned income credit they deserve, VITA saves clients hundreds of dollars in preparation fees. Each VITA client also receives financial education about saving receipts, maintaining a bank account and establishing a budget.

Owning a home is many people’s dream, but it can feel out of reach without sound financial planning and a little assistance. UF/IFAS Extension’s First-Time Homebuyer Education can help prospective homeowners get the financial education they need to qualify for down payment assistance on a new home. Participants also learn the good money habits that improve their credit scores, pay down debt and increase savings over time.

The school of life can be a harsh place, especially if you’re young. Given the chance, wouldn’t you rather learn lessons about finances without risking real money? Living On My Own (LOMO) is a financial literacy simulation program for youth. Students take on the roles of adults with a family to support, an assigned income, credit history, and bank account. In hands-on situations, they learn the fundamentals of financial management in a classroom before they have to struggle with it in real life.

Why It Works

Our partnership with Bank of America allows Extension agents to achieve certification as Accredited Financial Counselors, which makes them qualified to provide in-depth financial education to clients. Bank of America also provides material support for our financial education programs, including annual printing of the Florida Money Management Calendar, which helps participants keep track of bills and expenses month-to-month while sharing savings tips and strategies for building a spending plan.

Bank of America and UF/IFAS Extension are strong partners together because our goals are similar. We both want to provide people with the financial education to lead secure and fulfilling lives. Bank of America’s support for Extension financial management education is the result of its commitment to empowering Floridians of all income levels to achieve their dreams, whether it’s getting out of debt, saving for college or financing a new home.

The “How it Happened” series showcases the transformational gifts made by donors to UF/IFAS during the University of Florida’s Go Greater Campaign. To learn more about creating your own impact through UF/IFAS programs with a charitable gift, please visit our website at give.ifas.ufl.edu or call the UF/IFAS Advancement Office at 352-392-1975.

5

5