February 24 through March 1 is Florida Saves Week. A partnership between UF/IFAS Extension and the Florida Department of Financial Services, and with partial funding from Bank of America, Florida Saves is part of a nationwide education program to help people learn how to save their money and build wealth. Many families, especially those on modest incomes, believe that building wealth is the privilege of the wealthy. However, research shows that there are “savers” as well as “spenders” in all income brackets, and that the benefits of saving even small amounts of money over time contribute to stronger families and lower health risks—long-term wealth, however moderate, is health.

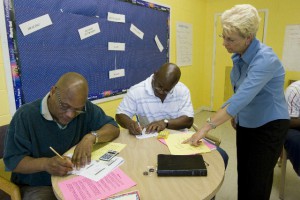

Florida Saves is just one of Extension’s many programs that provide families with research-based, unbiased financial management counseling: Florida Master Money Mentors is a training program for volunteers who go out into their communities to help people learn how to reduce their debt and begin saving for their future; Annie’s Project is a workshop that teaches the business of farming and ranching to women in agriculture; Financial Champions is a 4-H program that teaches young adults how to set financial goals and make smart consumer decisions.

Source: Smathers Archives

Farmers’ Cooperatives

Extension has been providing economic help to Floridians almost since the Agricultural Extension Service began in 1914. One of the first major tasks of Extension agents in the state was to help form cooperatives for farmers and ranchers. In the early 1900s, farmers usually bought their seed, fertilizer, packing containers and pesticides from a loan agency called a “factor.” These factors often charged extra fees on top of standard interest rates; a Florida potato farmer might wind up paying as much as 40 percent interest on a 90-day loan. And when the harvest was sold at market, farmers could do little to affect the price buyers would pay for their goods. To reduce supply costs and give farmers more financing and marketing clout, independent farmers needed to band together to form cooperative organizations. Many Extension agents did the legwork of creating the cooperatives—they contacted local banks, organized the farmers, drew the charter of the cooperative and managed its policies, usually on their own initiative. “At the time there were no Extension economists or marketing specialists at state headquarters,” said one former agent. “The county agent was a kind of Lone Ranger.”

In the early 1920s, when the Agricultural Economics Department was formed at the University of Florida, “Lone Ranger” county agents got the support of Extension economists, who charted national market trends and helped teach farmers how to keep careful financial records.

Source: Extension Annual Report, 1917.

Saving At Home

Early Extension agents knew that the key to family prosperity lay at home as well as out in the field. In 1915 Agnes Ellen Harris, the first female State Agent, organized a corps of Home Demonstration agents to teach farm women and children how to stretch their family budgets not only by canning, mending clothes and growing their own crops, but also by selling their homemade goods on the market. One of the more successful of these entrepreneurial efforts was the “egg circle,” where members of local poultry clubs pooled their surplus egg supplies and sold them on the market. Extension agents taught circle members how to grade, candle, market and ship eggs by parcel post, freight or boat. During the first world war, the scarcity of eggs yielded tidy profits for many women: In 1917, one egg circle sold 1,585 dozen eggs for about $500, an average of 32 cents per dozen—adjusted for inflation, that would be over $5 per dozen today.

From Producers to Consumers

Home Demonstration agents continued to teach self-sufficiency and ways to supplement income throughout the years of the Great Depression and the Second World War. In 1949, agent Gladys Kendall developed the Home Industries and Marketing Program to help families adjust to the post-war economy by teaching courses in financial planning, bookkeeping and making wise consumer choices. This new program shifted the emphasis away from the “grow your own” and income supplementing practices of the past, reflecting a more urban, consumer-oriented culture which has continued to this day.

Today, there are Extension education programs that cover all aspects of economics, from business advice for small farmers and beginning entrepreneurs, to world market analysis and economic impacts, to help with establishing credit and opening a savings account. Extension economics programs are focused on the future: Faculty in the Family, Youth and Community Sciences department recently created Florida Saves 2020, an initiative to help Floridians meet the financial challenges of the next decade. Just as Extension was there 100 years ago to help farmers struggling to make a living, it continues to help us all achieve our goals for the future.

Sources:

Cooper, J. Francis. Dimensions in History: Recounting Florida Cooperative Extension Service Progress, 1909-76. Gainesville: Alpha Delta

Chapter, Epsilon Sigma Phi, 1976.

Florida Agricultural Extension Service. 1917. Report of General Activities for 1917. Gainesville: University of Florida.

Florida Agricultural Extension Service. 1950. Report of General Activity for 1950. Gainesville: University of Florida.

0

0