The Consumer Financial Protection Bureau (CFPB) recently released its Financial Literacy Annual Report (2025), highlighting the importance of financial education for youth and providing valuable resources for educators and families. As someone passionate about financial literacy, I’m excited to share the four actionable strategies that align with CFPB’s framework and our work at the UF/IFAS Extension.

Why Financial Education Matters

- Executive Function – Skills like planning, self-control, and problem-solving.

- Financial Habits and Norms – Developing positive money habits and understanding social expectations.

- Financial Knowledge and Decision-Making Skills – Learning how to make informed financial choices.

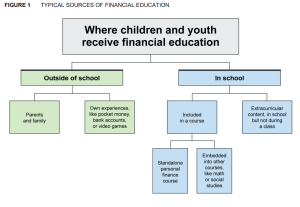

Figure 1: Typical Sources of Financial Education. Located on page 8 of the CPFB December 2025 Financial Literacy

Annual Report.

These building blocks guide how we design programs for young people. Youth learn about money from many sources—including social media. The challenge? Making sure the information they see is accurate and helpful. (See Figure 1: Typical Sources of Financial Education on page 8 of the CFPB December 2025 Financial Literacy Annual Report.)

Strategy 1: Use Research-Based Frameworks

Strategy 2: Share Opportunities & Collaborate

Strategy 3: Train Educators

Learn more about these programs:

- LOMO – https://blogs.ifas.ufl.edu/stlucieco/2025/04/02/national-financial-literacy-month-learn-about-lomo/

- Get Fin Lit! – https://blogs.ifas.ufl.edu/stlucieco/2025/05/30/get-fin-lit-this-july/

Strategy 4: Engage Families

- Set a family financial goal together.

- Talk about why it matters and involve your children in tracking progress.

Call to Action

0

0