Prices for stored peanuts remain relatively strong, but projected increases in peanut acreage this year dampen the outlook for the 2025 harvest price.

Recent Prices

Figure 1 shows the average monthly peanut price received by Florida producers. The peanut marketing year runs from August through July. The average Florida peanut price over the past 5 marketing years was $472/ton ($0.236/lb), according to USDA National Agricultural Statistics Service (NASS) data. Prices received by Florida peanut producers between August 2024 and February 2025 averaged $544/ton ($0.272/lb). The average price received by Florida growers for stored peanuts in February 2025 was $566/ton ($0.283).

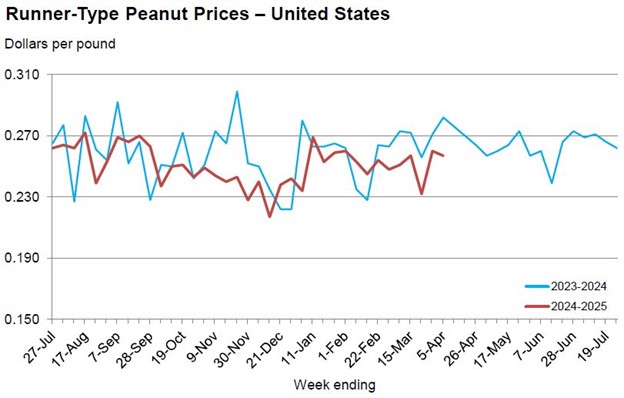

Figure 2 shows the national average price for runner-type peanuts so far this marketing year (red line) compared to last marketing year (blue line). Prices have been similar to last year. The national average price reported for runner-type peanuts was $0.257/lb ($514/ton) for the week ending April 5th, according to USDA-NASS data.

Prospective Plantings

The USDA released its 2025 prospective plantings survey results on March 31st. The report estimates the number of acres farmers will plant in various crops. As with any survey-based estimate there is a margin of error. Based on historical performance, there is 90% confidence that the actual peanut acreage will be within 13.4% of the survey estimate.

Table 1 shows the projected 2025 peanut acreage compared to the past five years in Florida and the United States. In Florida, projected acreage is 9% higher than 2024 and 10% higher than the 2020-2024 average. In the United States, projected acreage is 8% higher than 2024 and 20% higher than the 2020-2024 average.

|

2020 |

2021 | 2022 | 2023 | 2024 |

2025-P |

|

| Florida |

173,000 |

166,000 | 152,000 | 160,000 | 165,000 |

180,000 |

| United States |

1,658,500 |

1,578,300 | 1,448,500 | 1,645,000 | 1,801,000 |

1,950,000 |

Table 1. Acres planted in peanuts, 2020 to 2024, and 2025 projections. Data source: USDA National Agricultural Statistics Service (NASS).

Commodity prices and input costs can affect farmers’ planting intentions. Florida farmers are increasing peanut acreage at the expense of cotton and corn acres. These intentions suggest that for most Florida farmers, the profit outlook for peanuts looks better than for corn or cotton currently. However, the large projected increase in peanut acreage in Florida and nationwide is putting downward pressure on the price outlook for the 2025 harvest. Personal communication with two buying points indicated that contracts were offered briefly in February at $500/ton, but have not been offered since. Whether prices rise or fall at harvest time depends not only on the actual planted acreage, but also on yields per acre and demand for peanuts.

Supply & Demand Estimates

Table 2 shows U.S. peanut supply and disappearance forecasts for the current marketing year, as well as figures for the past two marketing years. Beginning stocks have declined since 2022, indicating tightening supplies over that time period. Although peanut acreage increased the past two years, declining yield moderated the increase in production. Strong U.S. consumption and exports in 2023/24 reduced ending stocks to a low 1,481 million pounds. Tight supplies have helped support peanut prices over the past year.

Peanuts are consumed domestically as peanut butter, snacks, candy, peanut oil, cake and meal, as well as seed peanuts. In the past few years, between 19% and 25% of U.S. peanut production was exported. The top three destinations for U.S. peanut exports in 2024 were Mexico, Canada, and the Netherlands (U.S. Census Bureau). Exports could be affected by trade policies or tariffs by peanut importing countries, as well as by currency exchange rates.

As shown in Table 2, U.S. ending stocks are forecast to increase by 11% this year (as of July 31st). That does not account for the 2025 harvest. If the projected 2025 acreage of 1.95 million acres is accurate and an average or trend yield is achieved, U.S. production would reach a new record. Unless demand for U.S. peanuts increases proportionally, peanut prices will likely fall from their current levels.

|

U.S. Beginning Stocks |

U.S. Production | U.S. Consumption | Net Exports | U.S. Ending Stocks | |

| 2022/23 |

2,360 |

5,542 | 4,775 | 1,094 |

2,033 |

| 2023/24 |

2,033 |

5,878 | 5,078 | 1,351 |

1,481 |

| 2024/25 |

1,481 |

6,448 | 5,189 | 1,095 |

1,645 |

Table 2. U.S peanut supply and disappearance (millions of pounds). 2023/24 data are estimates, and 2024/25 data are forecast. Adapted from USDA Economic Research Service, Oil Crop Outlook, April 2025.

Market Risk

Current prices for agronomic crops such as cotton, corn, and soybeans are low relative to production costs. Peanut prices are more favorable for producers currently, but a large increase in supply in 2025 would likely bring prices down. Producers of agricultural commodities face considerable market risk. Crop prices fluctuate frequently and cannot be predicted with certainty. Producers can take steps to help manage market risk. They can forward contract (when available), purchase Revenue Protection crop insurance, enroll in USDA farm safety net or marketing assistance loan programs, and diversify their farm enterprises. Those risk management steps do not guarantee positive profit margins, but they can help protect farmers against worst-case market outcomes.

3

3