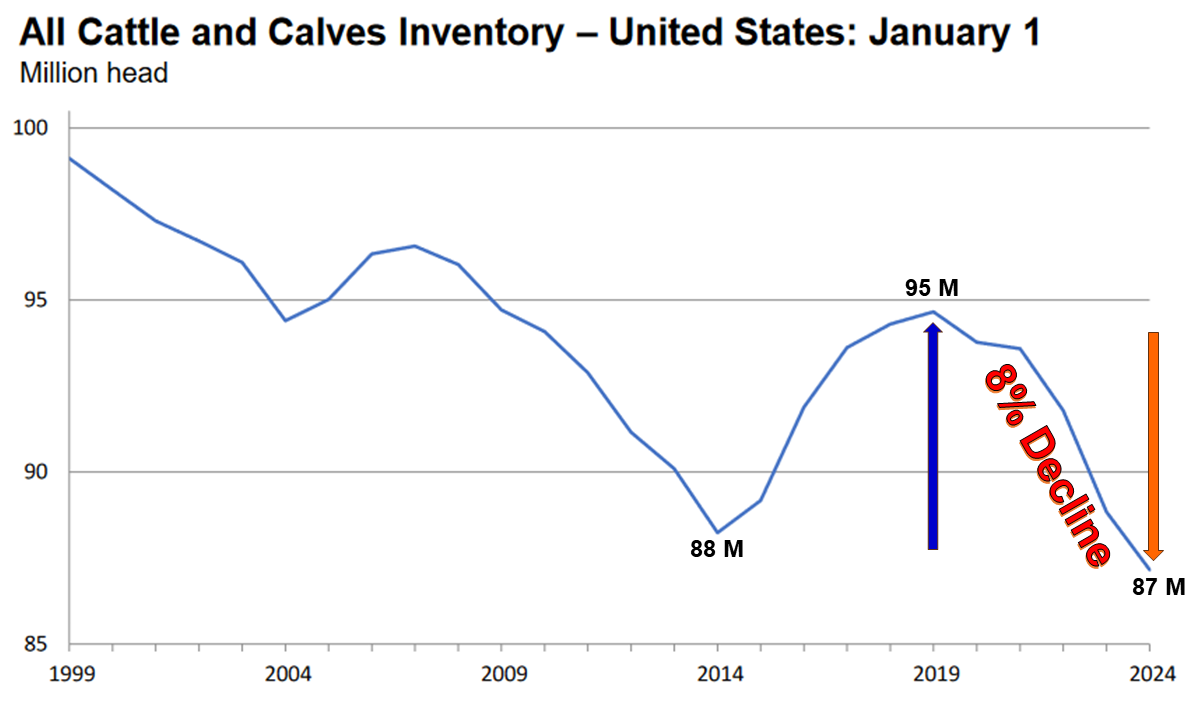

USDA’s National Agricultural Statistic Service (NASS) published their January 2024 Cattle Report on January 31st. As was expected, the US January 1, 2024 all cattle inventory dropped another 2%, as compared to January 1, 2023. NASS publishes an estimate of the US cattle industry every January and July. The all cattle and calves inventory was reported at 87.2 million head, which was 2% lower than the 88.8 million reported on January 1, 2023. According to NASS, the national cattle inventory declined for the 5th straight year since the recent peak of 94.8 million in 2019, for a total decline of 8% over that period. This is the lowest US cattle inventory since 82.1 million in January 1951. The most recent low was 87.7 million in January 2014.

–

–

The NASS Cattle Report also broke down the inventory by class. In Figure 2 above, you can see that while beef cows dropped 2%, dairy cows remained at the same level as compared to last year, as did replacement dairy heifers. Beef herd rebuilding has not started, in spite of an increase in cattle prices. Key indicators for this statement include a 2% reduction in cows and heifers expecting to calve in 2024, and a 1 % reduction in the replacement heifers, as compared to last year. Overall there were 3% less fall born calves under 500 lbs., and 2% fewer stocker calves over 500 lbs. The one area of significant increase was the cattle on feed, as drought forced producers to sell more heifer calves than last year. All of these changes resulted in a smaller beef herd in 2024 than in 2023.

–

–

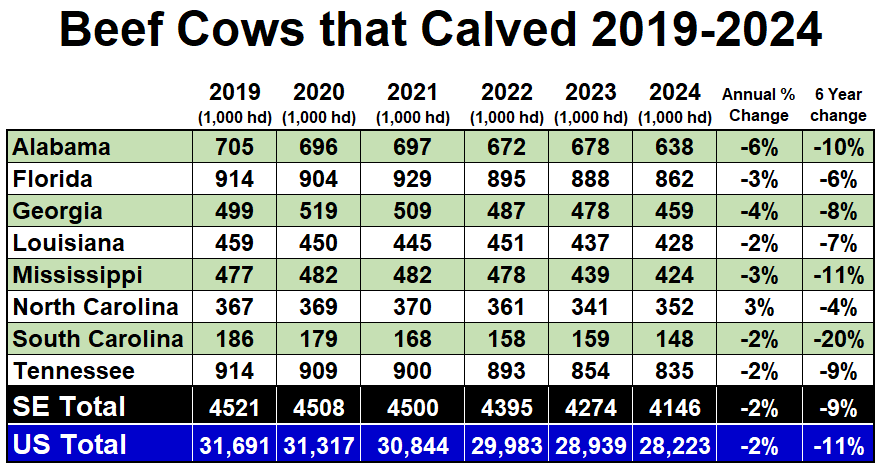

The NASS Cattle inventory report also provides breakdowns by state. In the Figure 3 above, you can see the beef cow herd reduction in the Southeastern States. The first comparison is from 2023 to 2024. You can see that Alabama saw the greatest herd reduction with 6% decrease last year from the year prior. Only North Carolina saw a 3% increase in beef cow inventory. The Florida beef cow herd shrunk 3% last year. Overall, the 2% herd reduction in the Southeast was similar the entire US. People may not think of the Southeastern states as major players in the cattle industry, but when you look at the totals, the Southeastern states represent almost 15% of the US total beef cow herd.

2019 was the peak in inventory in this cattle cycle. Since then, there has been an overall reduction in beef cows of 11% across the entire US, and 9% in the Southeast. Every state in the Southeast has declined since 2019. South Carolina has seen the greatest decrease with 20% fewer cows than five years ago. Mississippi dropped 11% and Alabama 10%, and over the last five years there are 6% fewer beef cows in Florida.

–

What does this mean for Panhandle Cattle Producers?

There are several important points to take away from the NASS January Cattle Report:

#1 There are fewer and fewer beef cows across the country. The basic economic concept of supply/demand says that as long as demand remains constant, when there is reduction in supply, prices go higher. Expectations for 2024 are for higher calf cattle prices than last year. The cow herd can’t rebuild in a single year, as it takes a supply of weaned and yearling replacement heifers to expand each herd.

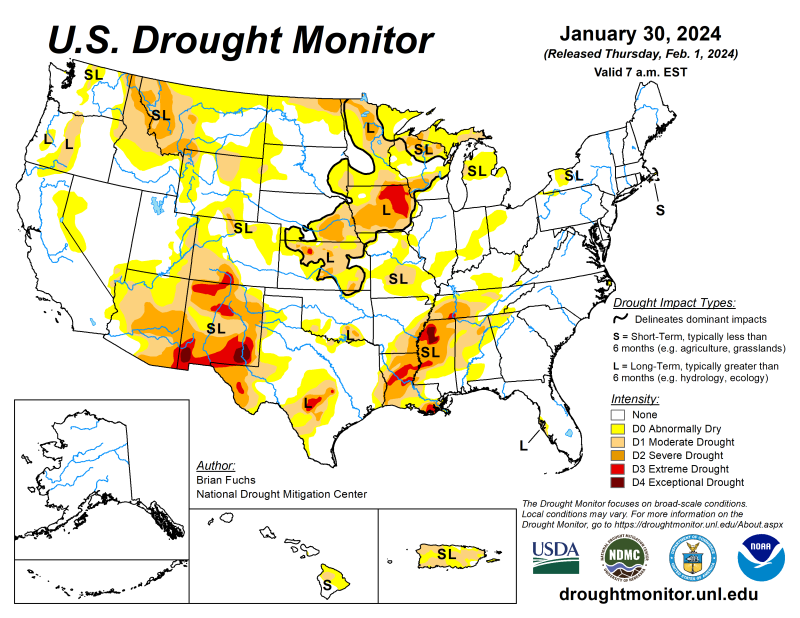

#2 Drought played a major role in the beef herd reduction. While there has been significant improvement nationwide, the January 30 Drought monitor map below shows that drought is still a major concern in parts of the country. While we think about the serious drought in the western states being a major factor in beef herd reduction, you can see in this map that the Mississippi River Valley has been really dry as well. El Niño has brought beneficial rainfall to Southern States along the Gulf, further inland is still very dry.

–

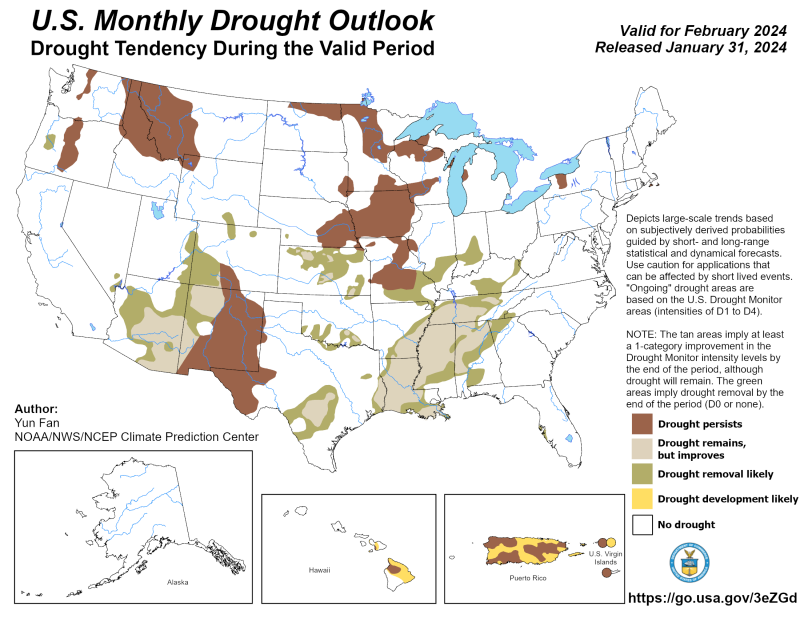

The 3-month drought outlook shows that improvement is expected for several areas that have been suffering from drought. This outlook is favorable, so it may be that pastures and range can once again handle higher stocking rates. This could trigger some herd expansion in the future.

#3 Herd expansion will take place with higher cattle prices, but it will take several years to rebuild the herd. Until we see an increase in replacement heifer retention, there can’t be any rapid increase in the beef cow herd inventory. Plus, since replacement heifers are in short supply, their value will likely increase, so expansion will be more expensive in the next few years.

#4 What will this mean for cattle prices in 2024? I encourage you to come to the Northwest Florida Cattle Beef Conference & Trade Show to hear Hannah Baker, UF/IFAS Beef Cattle & Forage Economics Specialized Agent, provide a 2024 Cattle and Input Market Outlook presentation. I am sure she will discuss how this change in cattle inventory will affect cattle prices this year. Input prices are still high, so producers will have to weigh the cost of expansion carefully to take full advantage of this opportunity for profitability.

1

1