As parents or caregivers, one of the concepts that we need to teach to our children is the responsibility that comes with handling money. This becomes a valuable tool for them to use as they grow and develop into adulthood. One of the most difficult skills for a child to learn is how to spend wisely and delay gratification. They will develop patience and planning skills in other aspects of their lives. Talking to your kids about money at an early age can help them understand the value of the dollar, how to save for long-term goals and how to spend responsibly. Teaching children about finances can build financial literacy and give them a stronger ability to manage their finances later in life.

“Sometimes parents wait until their kids are in their teens before they start talking about managing money — when they could be starting when their kids are in preschool.”

Warren Buffett

Important Tips

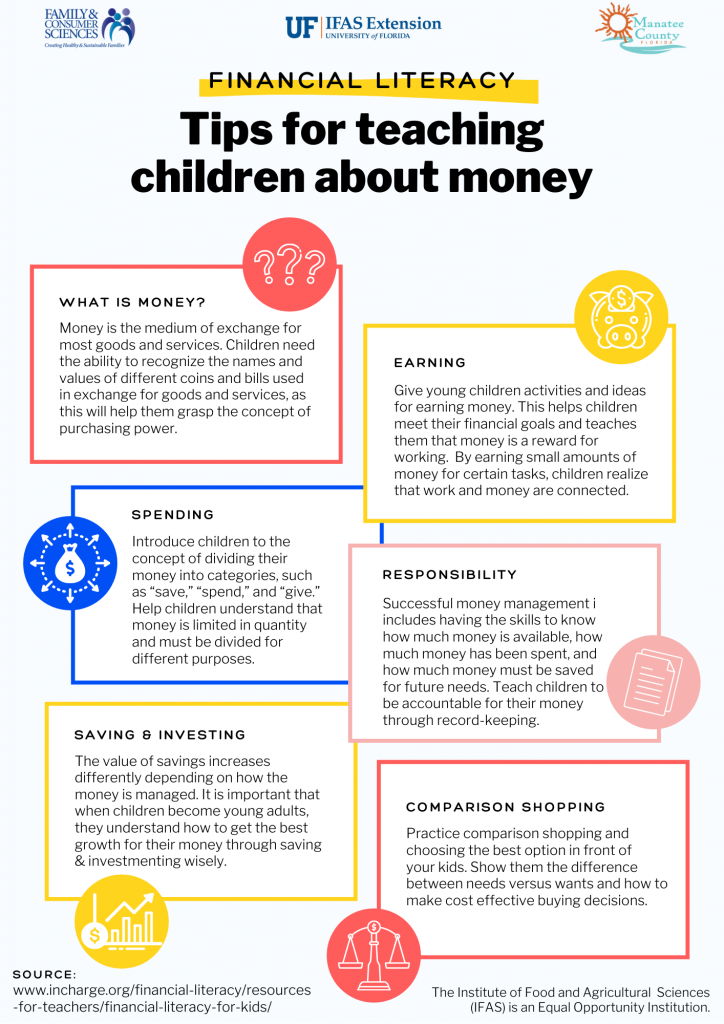

What is Money?

It is a medium of exchange for most goods and services. Children need he availability to recognize the names and values of different coins and bills used in exchange for goods and services, as this will help them grasp the concept of purchasing power.

Earning

Give your children activities and ideas for earning money. This helps children meet their financial goals and teaches them than money is a reward for working. By earning small amounts of money for certain tasks, children realize that work and money are connected.

Spending

Introduce children to the concept of dividing their money into categories, such as save, spend and give. Help children understand that money is limited in quantity and must be divided for different purposes.

Responsibility

Successful money management includes having the skills to know how much money is available, how much money has been spent, and how much money must be saved for future needs. Teach children to be accountable for their money through record-keeping.

Saving & Investing

The value of saving increases differently depending on how the money is managed. It is important that when children become young adults, they understand how to get the best growth for their money through saving & investment wisely.

Comparison Shopping

Practice comparison shopping and choosing the best option in front of your kids. Show them the difference between needs versus wants and how to make cost effective buying decisions.

1

1