Florida agriculture has remained viable and strong through the current economic downturn. The widely held view of financial vigor may have some long-term effects on commodity prices. Negotiations are heating up in Washington D.C. on the 2012 Farm Bill and all indications are it will be very different from past enactments. Pressure is building for reduced financial support of farm commodities. Though commodity prices are historically high, short-term investments which can improve efficiency for leaner times in the future may be prudent.

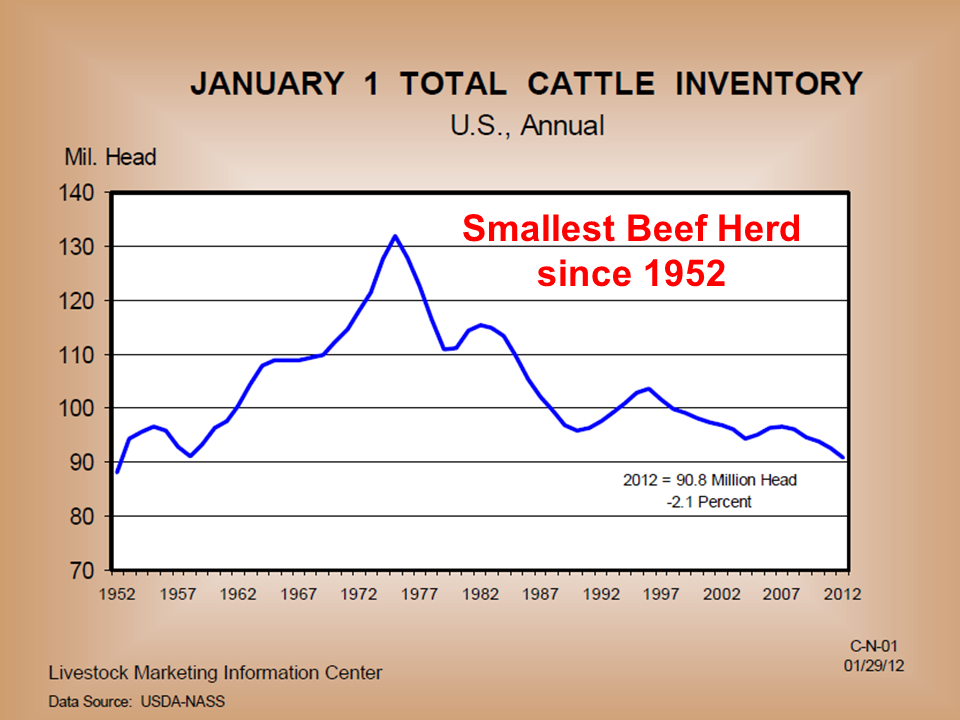

Supply and demand is the ultimate driver in agriculture commodity markets, unless Federal programs alter the economic landscape. Drought in production areas, a weaker U.S. dollar, and increasing world demand for food and fiber have combined to keep cattle, cotton, peanut, and corn prices elevated. However, when the variables change market prices adjust, as seen with the cotton market recently. The cattle market is still very strong. The following chart shows the total cattle inventory in the US as of January 1, 2012, the lowest in 60 years.

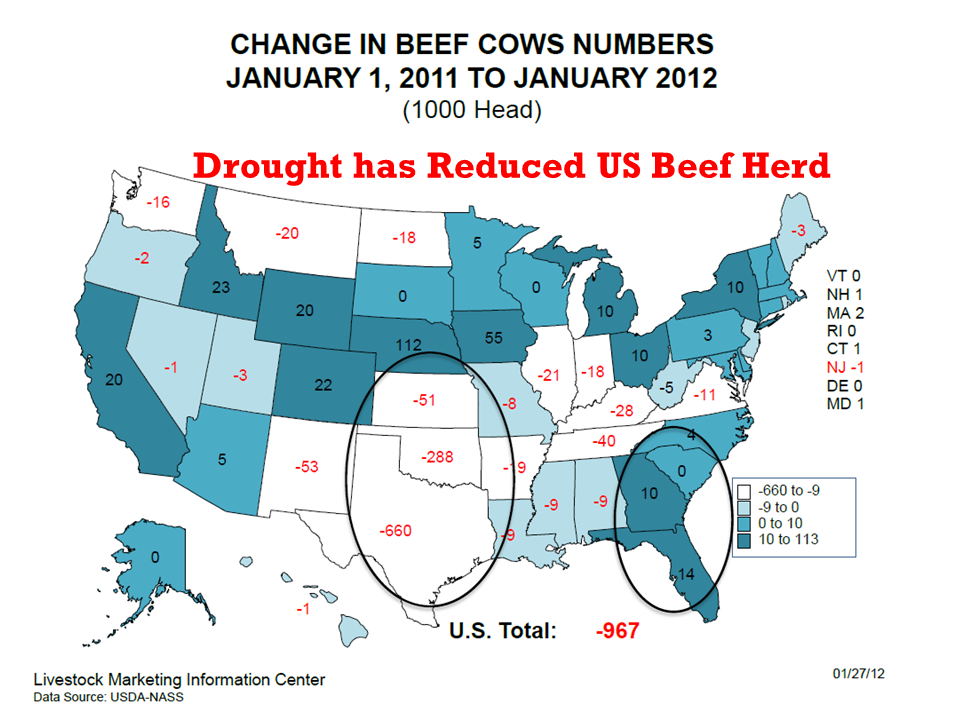

What caused this shift in inventory? Two years of severe drought in some areas, and competition from high-priced corn with pasture acres in the corn-belt caused a reduction of almost 1.5 million head from the breeding herd. The following chart shows where the greatest reduction that took place just this past year.

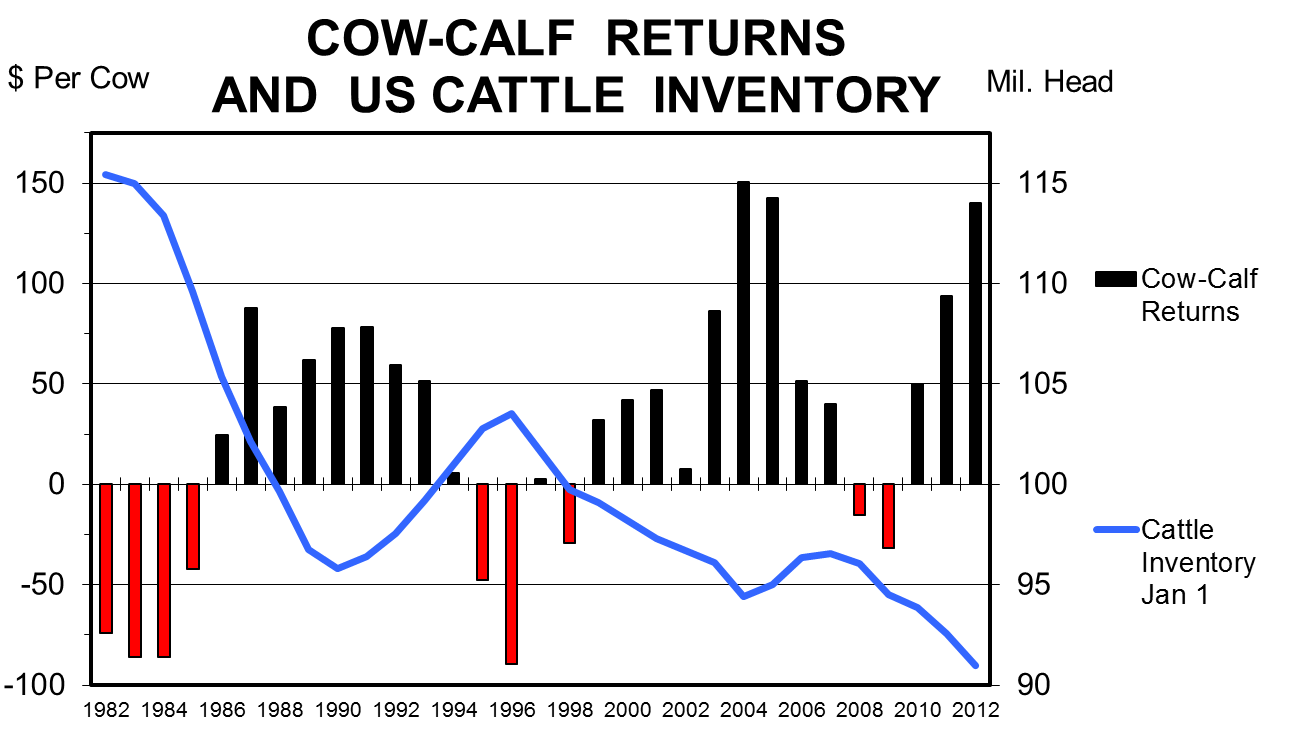

So why does this matter? A low inventory of breeding cattle reduces the supply of feeder cattle and ultimately affects profitability for cow-calf producers. Basic economics of supply and demand dictate market prices. With demand relatively unchanged, prices are higher when the national inventory is low. Eventually, the national cow herd will slowly be rebuilt and prices will return to more normal levels.

The example of the cattle industry is the most extreme of our local agricultural commodities, but others like peanuts and cotton are similar. Drought and a shift to corn acres have affected market prices for these crops as well. Eventually, commodity markets will adjust. The difference will be that these commodities may not have the price support from the next farm bill. So, it is important to start considering some short-term investments that will improve the long-term efficiency of your operation.

Every operation is different, but there are a number of things worth considering. Below is a list of some possible investments that may improve the efficiency of your operation. The NRCS EQIP program may even provide matching funds for practices that meet their guidelines.

- Technology

- Precision agriculture (guidance, mapping, variable rate application, etc.)

- Low volume irrigation

- Computer software for record keeping and analysis

- Herd Synchronization and AI

- Input Cost reduction

- Bulk feed storage and feeding

- Transition from diesel to electric irrigation

- Strip tillage

- Equipment & hay storage

- Production improvement

- Improved varieties of crops & forages

- Better bulls & replacement heifers

- Individual animal identification & records

- Sod-based crop rotation

- Pasture cross-fencing and cowpens

The bottom line is to give some thought to the future. Just like cotton this year, market prices will change (suddenly sometimes). The Farm Bill may not provide the support for commodities in the same manner as in the past. Demand for US agriculture remains strong, but markets will rise and fall. The most efficient operations will be the ones that survive long-term.

0

0