What is an acceptable value for leasing land?

Many agriculture producers rely on leased land to produce their product. The USDA National Agriculture Statistics Service provides data based on regions, states, and counties. This information is based on volunteer survey completion, but offers a valuable tool to help land owners and agriculture producers reach a fair price for the exchange of the land use.

What is reported?

The land use is divided into three categories and is reported on a cash dollar amount per acre ($/A);

- Irrigated Cropland

- Non-Irrigated Cropland

- Pasture

US and State estimates are available the first week of August every year, and county estimates are published the second week of September every other year (2019 will be an updated year).

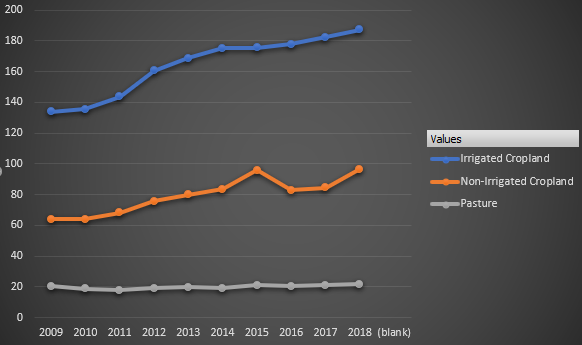

What are the national averages?

The national averages are showing a general increasing trend in the past 10 years, which can be correlated to the value of the products produces and the differences in markets. In the table below, using the data from USDA as of 2018, there is a clear trend in the increasing cost of both types of cropland, while pasture values have stayed fairly constant. The 2018 national averages were $187.07 for Irrigated cropland, $96.43 for non-irrigated cropland, and $21.76 for pasture.

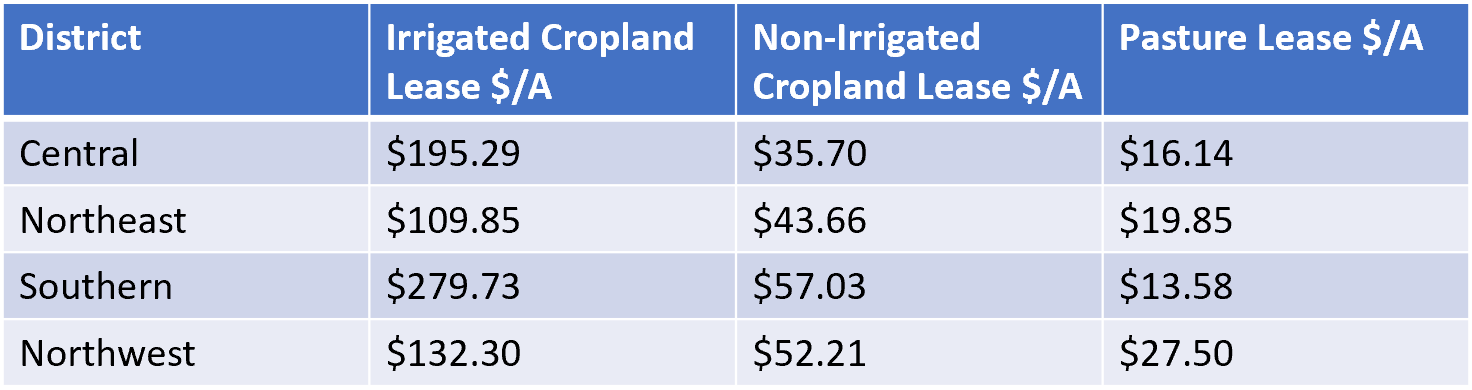

How does Florida compare to the national averages?

There was a lot of variation within the state of Florida. Based on breaking the state into districts, or regions, the chart below compares the average $/A of the three types of land leases in Florida

0

0